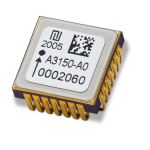

Supplier of high performance digital inertial MEMS sensors

and

Provider of inertial MEMS foundry services

MEMS sensing

designs and process

Part of TDK Sensor Systems Business Company

Following a tender offer in January 2017, TDK Electronics AG (formerly EPCOS AG) holds a majority of Tronics’ shares and Tronics became a division of TDK’s Temperature & Pressure Sensors Business Group. We are now part of the Sensor Systems Business Company of TDK together with TDK Temperature and Pressure Sensor Business Group, TDK Magnetic Sensors Business Group, TDK-Invensense, TDK-Micronas, and ICSense. TDK SSBC is now one of the largest manufacturer and provider of sensors and sensors solutions.

We are the only supplier of high performance digital closed-loop inertial MEMS sensors components – acceleration sensors and angular rate sensors (gyros) – and a provider of custom inertial MEMS foundry services.

We are IATF16949 certified and we operate a 6” MEMS front-end facility with an assembly, packaging and calibration line for inertial sensors. Since our inception in 1997, Tronics has been providing differentiated high performance products and services for demanding industrial, oil & gas, railway, marine and aerospace applications.