Strong demand of €24.2 million (Offer 2.7 times oversubscribed) ; price fixed at €13.20 per share ; start of trading on 13 February 2015

VIEW ONLINE: > Official Press Release – February 10, 2015

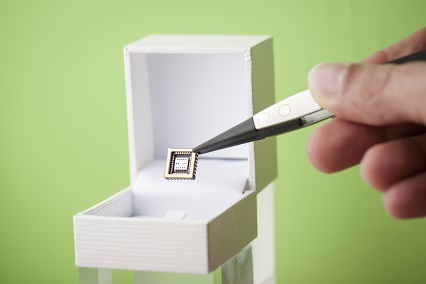

Tronics Microsystems, a designer and manufacturer of innovative nano and microsystems, has successfully carried out an initial public offering on Euronext’s regulated market in Paris.

The offer, which closed on 9 February 2015, generated strong interest from institutional investors as well as individual investors.

The Global Placement (“GP”) was more than 2 times oversubscribed and the open price offer “Offre à Prix Ouvert” was 8.6 times oversubscribed.

The Thales Group, which had committed to invest €6 million through this transaction, acquired an equity stake in Tronics of €4.3 million, corresponding to approximately 9.5% of the capital and 5.5% of the voting rights. In accordance with the commitments made in the context of this investment, it is anticipated that a director named by Thales will join the Supervisory Board of Tronics.

Through the planned initial public offering, the Safran Group acquired an equity stake of €2.7 million, corresponding to approximately 5.9% of the capital and 3.4% of the voting rights.

Free float (excluding historical and industrial shareholders) represents 10.9% of the capital.

In response to the strong demand, the Supervisory Board, in its meeting of 10 February 2015, decided to fully exercise the extension clause and recorded the full exercise of the over-allotment option. It also decided to set the price at €13.20.

In total, the number of securities issued represents 909,091 shares, leading to a capital increase of €12 million (including the issue premium). The market capitalization of Tronics amounts to €45.8 million.

A liquidity contract will be implemented with brokerage firm Gilbert Dupont as soon as trading starts on 13 February 2015.

Pascal Langlois, Chief Executive Officer, said: “We are particularly proud and pleased by our successful Initial Public Offering. We kindly thank the new institutional, industrial and private investors who have joined us. The funds raised will enable us to accelerate our international deployment, to strengthen our engineering team and to pursue a strong innovation policy in the sector of nano and microsystems with high added value”.

The funds raised will enable us to accelerate our international deployment, to strengthen our engineering team and to pursue a strong innovation policy in the sector of nano and microsystems with high added value